Top 10 of 2018: #6 – $115 Million Stewart Debt Plan to Push Costs to Future

Many important stories have been covered by the New Britain Progressive in 2018. It may be difficult to name only a few articles as the top stories of the year, but there are a few the New Britain Progressive would like to share as our Top Ten. Other Top Ten stories can be found at “Top Ten Stories of 2018.”

Just as 2018 began, Republican Mayor Erin Stewart introduced her controversial proposal to borrow $115 million to push city debt into the future. (Stewart Calls Special Council Meeting to Borrow $115 Million to Push Debt into Future)

The proposal was widely seen as the result of Stewart’s practice of pushing millions of dollars of debt into the future to artificially lower costs during her administration at the expense of higher future debt payments for city taxpayers.

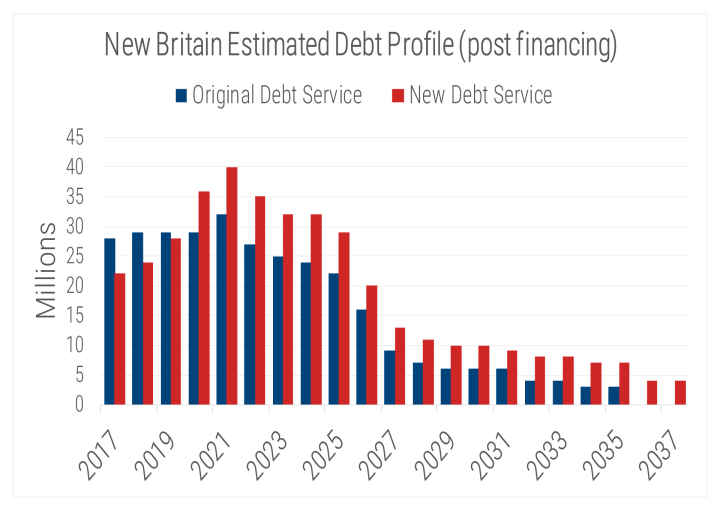

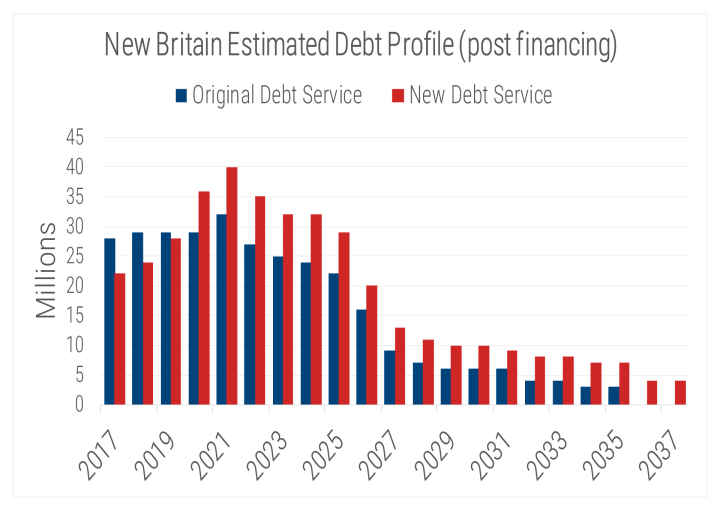

In early 2017, Stewart had already come under intense criticism for that budgeting practice. (City Hall Watch: Deferring Municipal Debt Payment Means Cash Now, Higher Interest Next Year) Later that year, a graph from the city was obtained that strikingly showed that a city “debt restructuring,” under Stewart had resulted in a reduction in short-term debt payments, while pushing that debt into a spike in taxpayer debt payments hitting the city budget in upcoming years.

Stewart’s opponent in the 2017 Mayoral election, Merrill Gay, had highlighted concerns about the effect of Stewart’s refinancing policies on the city’s future. That appeared to be confirmed by John Healey, Stewart’s former Chief of Staff and then a Managing Director for the city’s debt underwriter, Mesirow Financial, in a presentation before the City Council on December 11, 2017, in which he admitted that, “A lot of what was said over the course of the campaign, as far as, you know, the city’s restructuring and the debt that, the debt spikes that are out there – that was absolutely true.”

Stewart’s January, 2018, $115 million borrowing plan was quickly seen as both an effort to push past borrowing Stewart had done to cover previous years’ costs into the future and giving her the authority to borrow more to cover future budgets. Both were seen as Stewart trading tough choices between budget cuts and even higher taxes during her own administration for debt city taxpayers would have to pay into future generations.

Gay commented on Facebook on January 10th that, “For the 3rd time in three years, Mayor Stewart is proposing to refinance the city’s debt. Each time, it has been for one purpose, to get her through the next budget without a tax increase or major cuts.”

“What the mayor has done is the equivalent of paying the MasterCard with the Visa,” Gay commented. “When you can’t pay the debt you owe, the answer is not to borrow more money,” adding that Stewart, “borrows the money from our kids to spend it now.”

The City Council voted to send Stewart’s plan back to committee for further consideration on January 10, 2018. Despite reservations about it, the newly-elected Democratic Council majority did not outright reject it, while Republicans signaled that they also supported Democrats’ desire to seek additional options to address the upcoming spike in debt payments. (Council Sends Stewart $115 Million Borrowing-Refinance Plan Back to Committee)

However, online commentary by Republican politicians, and Stewart, herself, that was derided as, “juvenile,” ridiculing a budget question Ald. Manny Sanchez (D-AL) had posed, ended the brief bi-partisanship on the issue. (Republican Ridicule Breaks Short-Lived Bipartisanship on Consideration of Stewart Debt Plan)

Stewart rebuffed calls by Council Democrats for thorough review of her plan, calling the Council meetings on January 17th (Stewart Rebuffs Democrats’ Call for Further Consideration of $115 Million Debt Plan) and January 25th (Stewart Calls Third Meeting on Approving $115 Million Borrowing-Refinance Plan). This, and theatrics she carried out for the press and online were called by many as heavy-handed tactics to pressure Council Democrats into a quick approval of her $115 million plan.

Despite this, Democrats did not approve Stewart’s plan at either meeting (Council Adjourns Meeting Without Approving Stewart $115 Million Borrowing Plan) and defended the time that they were taking to consider the proposal (Ald. Ayalon Says $115 Million Borrowing Plan and Other Decisions Should Not be Rushed).

Still, facing the prospect of Stewart’s past budgeting resulting in a spike in annual debt payments as high as $39 million in a single year, the Council, in March, approved a scaled down version of Stewart’s debt plan. The approved plan decreased the length of time taxpayers would be paying down the debt from Stewart’s original plan and reduced the overall size of the borrowing authorization to $99 million. (Council Approves Scaled-Down Version of Stewart Borrowing Plan)

This is a story of significance that will be relevant to the city well into the future, and it is certainly one of the Top Ten stories the New Britain Progressive covered in 2018.

Stewart Calls Special Council Meeting to Borrow $115 Million to Push Debt into Future

January 4, 2018

Republican Mayor Erin Stewart has called a special meeting of the City Council to consider a plan to borrow $115 million to, “Refund Any of the City’s Outstanding General Obligation Bonds.”

Stewart issued her official warrant calling the meeting on January 3, 2018. On the same day, the city’s debt underwriter, Mesirow Financial, issued an Executive Summary of a plan, bearing the city’s seal, for a 2018, “Debt Restructuring.” This document discusses a plan involving borrowing money to lower debt payments in the short term at a cost of rising future taxpayer debt costs.

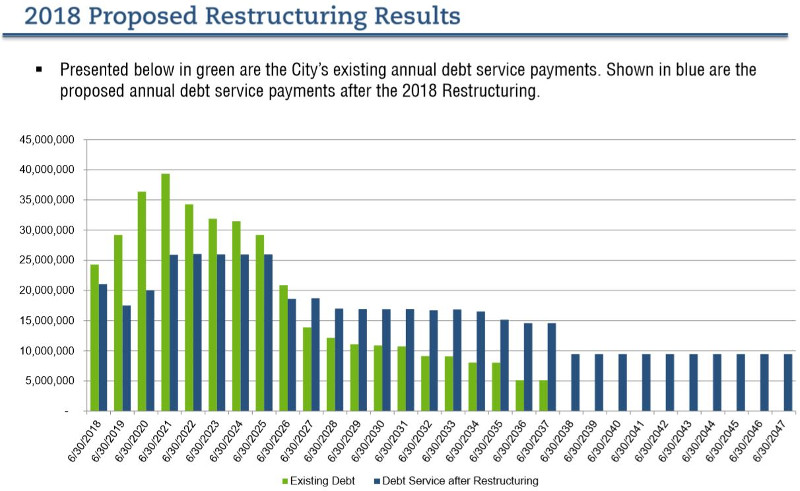

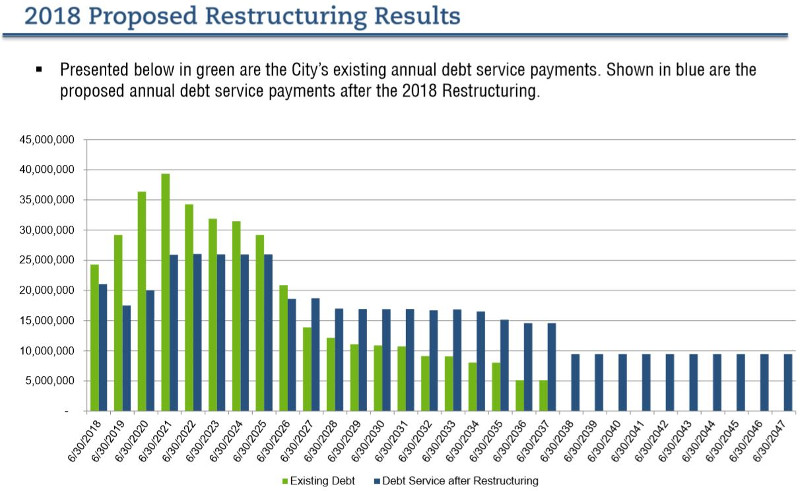

Graphic shows New Britain’s escalating debt payments. (Source: Municipal Budget Book)

Stewart has come under intense criticism for having already pushed millions of dollars of debt into the future, to artificially lower costs during her administration, at the expense of higher debt payments for city taxpayers into the future. A graph from the city was obtained that showed that this “debt restructuring,” has resulted in a reduction in short-term debt payments and a spike in taxpayer debt payments in upcoming years.

While Stewart has dismissed critiques about city debt under her administration as politics, a major credit rating agency downgraded its assessment of New Britain, citing city debt and spiking debt payments in its analysis.

John Healey, Stewart’s former Chief of Staff and a current Managing Director for Mesirow, in a presentation before the City Council on December 11, 2017, admitted that, “A lot of what was said over the course of the campaign, as far as, you know, the city’s restructuring and the debt that, the debt spikes that are out there – that was absolutely true.”

The new 2018 “debt restructuring” plan in the January 3rd Mesirow document would be of a more substantial scope. The plan would use up to $115 million dollars in city borrowing to pay existing city bonds, creating new debt that would push continuing taxpayer debt payments into the future.

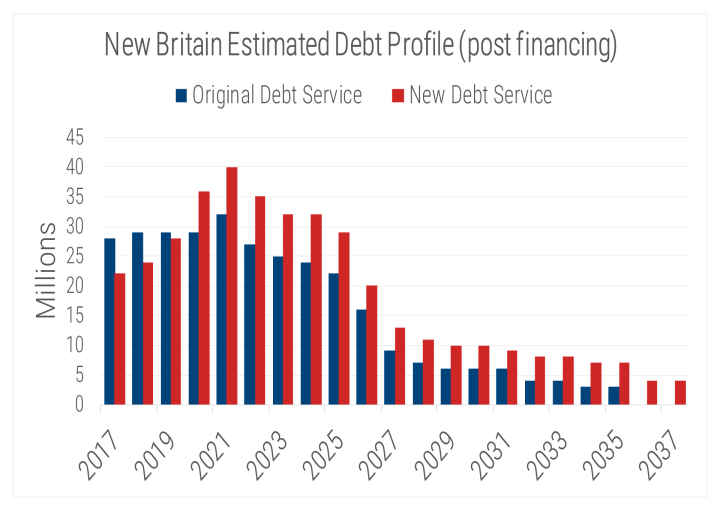

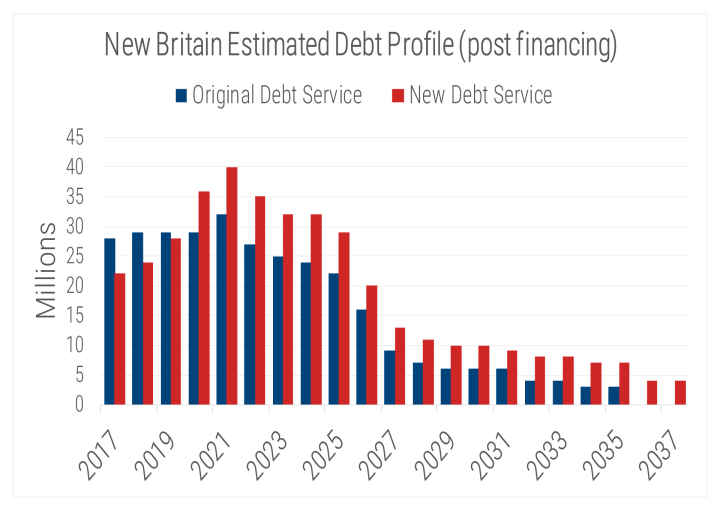

City taxpayers would be making smaller payments on existing city debt in the current year and next eight years, with the largest saving being in the three years following the current year.

After the year 2026, however, taxpayer payments on existing city debt would increase, becoming dramatically higher over the course of twenty-one years. The plan would add an additional ten years to the taxpayer’s payments on existing city debt.

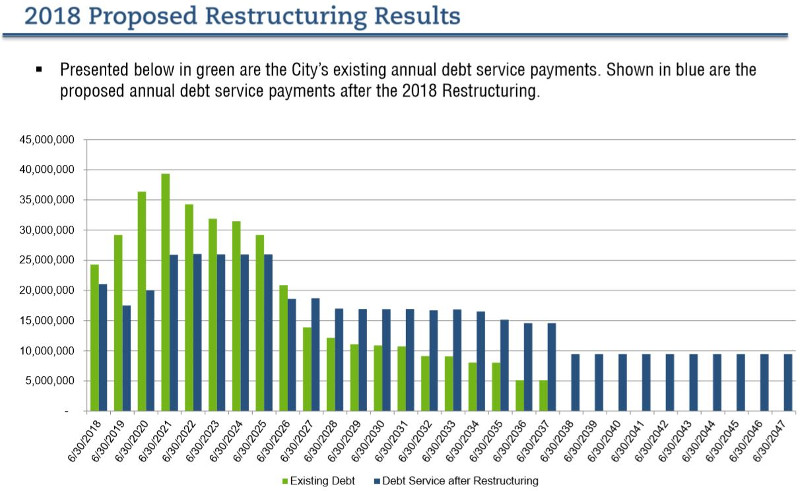

From the city’s debt underwriter, Mesirow Financial.

As part of the plan, the proposed Council resolution would also authorize Stewart to pay, “applicable redemption premiums.” Redemption premiums would generally refer to additional amounts that the city would have to pay in order to pay the city’s existing debt early.

In addition to refinancing existing bonds, the plan in the Mesirow document would also use new city borrowing to pay, “interest on outstanding bonds through and including March 2020.” The proposed Council resolution would authorize Stewart, “to pay interest costs on such bonds through June 30, 2020.”

The special City Council meeting is to be held on January 10, 2018 at 6:45pm in the Council Chambers on the second floor of City Hall.

Council Sends Stewart $115 Million Borrowing-Refinance Plan Back to Committee

January 11, 2018

The City Council voted to send Republican Mayor Erin Stewart’s controversial plan to borrow $115 million to push current city debt into the future back to the Council’s Bonding Subcommittee.

In making his motion to refer the matter back to committee, the Democratic Council Majority Leader, Ald. Carlo Carlozzi (D-5) expressed the desire of Council members to explore other options than the one presented to them. “We are going to be looking at additional options. Instead of just this one plan, we are going to see what other plans are available.”

Republican Leader Ald. Robert Smedley (R-4) seconded the motion and Republican Mayor Erin Stewart said that she supported additional time to consider other options. However Stewart also said that a special meeting will be called to consider that matter in one week, on January 17th.

The “Debt Restructuring” discussed in a January 3, 2018 plan issued by the city’s debt underwriter, Mesirow Financial, would involve borrowing money to lower debt payments in the short term at a cost of rising future taxpayer debt costs. The plan would use up to $115 million in city borrowing to pay existing city bonds, creating new debt that would push continuing taxpayer debt payments into the future.

City taxpayers would be making smaller payments on existing city debt in the current year and next eight years, with the largest saving being in the three years following the current year.

After the year 2026, however, taxpayer payments on existing city debt would increase, becoming dramatically higher over the course of twenty-one years. The plan would add an additional ten years to the taxpayer’s payments on existing city debt.

From the city’s debt underwriter, Mesirow Financial.

In addition to refinancing existing bonds, the plan in the Mesirow document would also use new city borrowing to pay, “interest on outstanding bonds through and including March 2020.” The proposed Council resolution would authorize Stewart, “to pay interest costs on such bonds through June 30, 2020.”

The plan would also authorize Stewart to pay, “applicable redemption premiums.” Redemption premiums would generally refer to additional amounts that the city would have to pay in order to pay the city’s existing debt early.

The plan in the Mesirow document would be of a more substantial scope than earlier debt refinancing that has been the source of intense criticism of Stewart. Critics say that she has already pushed millions of dollars of debt into the future, to artificially lower costs during her administration, at the expense of higher debt payments for city taxpayers into the future.

Graphic shows New Britain’s escalating debt payments from previous refinancing. (Source: Municipal Budget Book)

Last year, a graph from the city was obtained that showed that this “debt restructuring,” has resulted in a reduction in short-term debt payments and a spike in taxpayer debt payments in upcoming years.

Stewart’s opponent in the 2017 Mayoral election, Merrill Gay, had highlighted concerns about the effect of Stewart’s refinancing policies on the city’s future.

That appeared to be confirmed by John Healey, Stewart’s former Chief of Staff and a current Managing Director for Mesirow, in a presentation before the City Council on December 11, 2017, in which he admitted that, “A lot of what was said over the course of the campaign, as far as, you know, the city’s restructuring and the debt that, the debt spikes that are out there – that was absolutely true.”

Gay commented on Facebook on January 10th that, “For the 3rd time in three years, Mayor Stewart is proposing to refinance the city’s debt. Each time, it has been for one purpose, to get her through the next budget without a tax increase or major cuts.”

“What the mayor has done is the equivalent of paying the MasterCard with the Visa,” Gay commented. “When you can’t pay the debt you owe, the answer is not to borrow more money,” adding that Stewart, “borrows the money from our kids to spend it now.”

Republican Ridicule Breaks Short-Lived Bipartisanship on Consideration of Stewart Debt Plan

January 13, 2018

Only hours after Republican Mayor Erin Stewart and Council Democrats had spoken in collaborative terms about the process of considering her proposal to borrow $115 million to push city debt into the future, the bipartisan spirit was broken when Stewart and other prominent Republicans openly ridiculed a Democratic Council member for a question he had asked about the city’s finances.

On the night of the City Council meeting on January 10, 2018, at which Stewart’s controversial debt plan was discussed, Democratic Ald. Emmanuel Sanchez (D-AL) commented on Twitter that, “The debt restructuring plan before us at tonight’s New Britain City Council meeting did not pass. That being said, I was happy to see both parties/sides agree to revisit this vital matter and consider different structural plans at a later meeting.”

Both Democrats and Republicans at the meeting voted together to return the $115 million borrowing plan back to a Council committee to examine various options, and Stewart had spoken favorably about the further consideration of options.

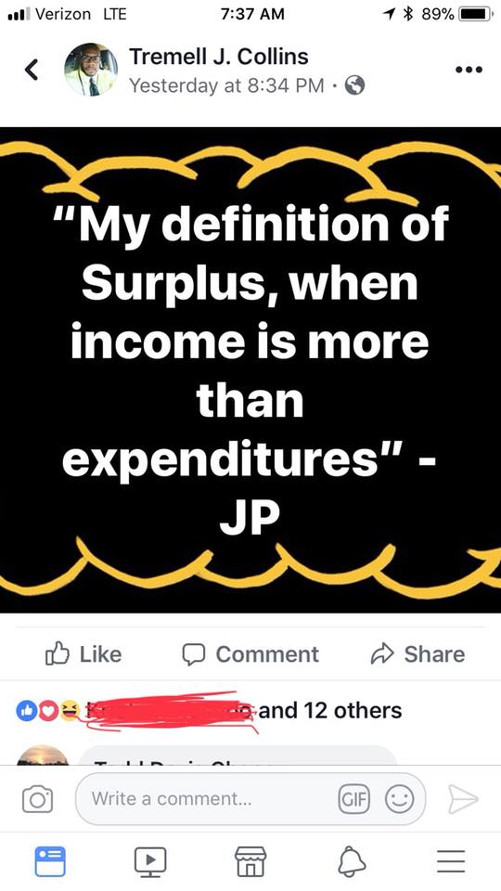

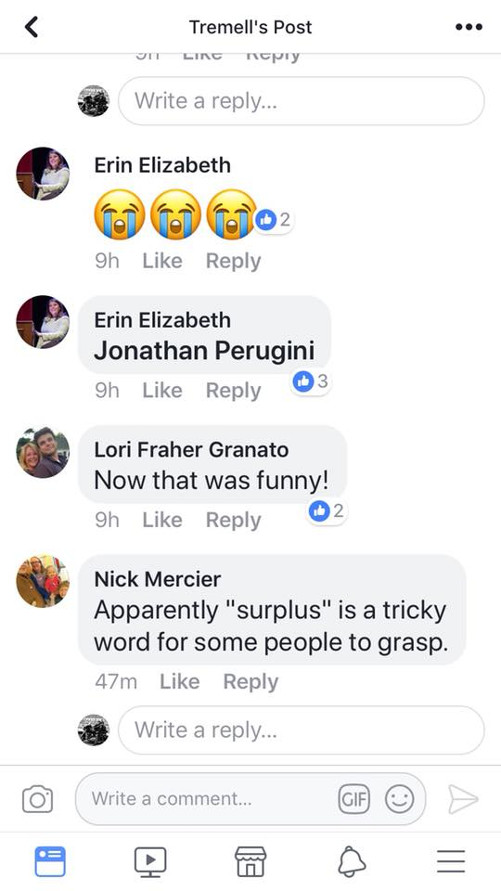

But then Sanchez posted two images from Facebook commentary, apparently made by former Republican Ald. Tremell Collins, Republican Board of Education President Nick Mercier and Stewart, herself, ridiculing a question Sanchez had posed concerning a city surplus. “Apparently ‘surplus’ is a tricky word for some people people to grasp,” said Mercier.

“I guess I spoke too soon,” Sanchez commented on Twitter, “…so much for bipartisanship. #ITried.”

Responding to the ridicule, Sanchez, said, “During the City Council meeting I asked several questions about the debt, yes, I did ask the representative from the finance team to define what a ‘surplus’ is. I did so for better clarification regarding what it meant for our city, given that the word ‘surplus’ as an accounting term, can be manipulated to create illusions of fiscal responsibility by the Mayor and her administration.”

“We as elected officials and the community have questions about the future of our city’s finances,” said Sanchez. “It’s unfortunate that it becomes social media humor amongst some of our city leaders — when questions are asked.”

The Republicans’ ridicule has been been derided on commentary online as, “childish,” “unprofessional and immature,” and “juvenile.”

“New Britain residents know that we do not have a ‘structural surplus’,” Sanchez said, “because we have debt to pay and we are using borrowed money to assist us in those payments. Any mention of a ‘surplus’ would be deceitful and intentionally twisted. Simply put: this is why I asked the question on the record.”

“Well said alderman,” commented Democratic Ald. Richard Reyes (D-AL). “Apparently, by the comments posted, the Mayor, Finance Director, and Board of Ed member took it to the gutter. Not surprised.”

“You know what is more funny than her minions laughing?,” asked Ald. Iris Sanchez (D-3), “The mess she is into and now they want the DEMS to pay for it.”

“The Council approves the City budget and debt restructuring,” said the Council President Pro-Tempore, Ald. Eva Magnuszewski (D-AL). “The current financial situation the City is in is not a laughing matter. It is not cool that the Mayor, Finance Director and a Board of Education member chose to make fun of an Alderman asking about important fiscal matters.”

Democratic Ald. Katie Breslin (D-5) added, on Twitter, that, “We get it. It’s easy to make fun of bits & pieces of a meeting. But the big picture – the context – is that we are trying to learn and identify and fix the structural issues in our budget. That when debt payments are deferred, they aren’t labeled surplus.”

“I’m trying to help solve the financial issues we are facing in this city,” said Sanchez. “Lets come together, roll up our sleeves and find real solutions. We should never feel discouraged to ask the hard questions, or any questions at all.”

“The Dems on New Britain City Council will continue to be as professional as possible and remain laser focused on the issues,” Reyes added on Twitter.

Under Stewart’s debt plan, city taxpayers would be making smaller payments on existing city debt in the current year and next eight years, with the largest saving being in the three years following the current year. After the year 2026, however, taxpayer payments on existing city debt would increase, becoming dramatically higher over the course of twenty-one years. The plan would add an additional ten years to the taxpayer’s payments on existing city debt, and, according to City Council members, would add over $69 million to city debt service.

Stewart Rebuffs Democrats’ Call for Further Consideration of $115 Million Debt Plan

January 18, 2018

City Council Democrats called on Republican Mayor Erin Stewart to delay action on her proposal to borrow $115 million to push city debt into the future. The Council majority is seeking more public input and consideration of other options before re-structuring of finances and committing the city to long-term borrowing. While Democrats asked that the January 17, 2018 special Council meeting be delayed the Mayor ignored the request and gaveled the meeting to order, anyway, without Democrats.

The special Council meeting had been called one week after the January 10th special meeting, at which the Council had referred the borrowing and refinance plan back to a committee. At that meeting, Ald. Carlo Carlozzi (D-5) expressed the desire of Council members to explore other options than the one presented to them. “We are going to be looking at additional options. Instead of just this one plan, we are going to see what other plans are available.” Both Democrats and Republicans had voted together to return the measure to committee, and Stewart had spoken favorably about the further consideration of options.

But Stewart also effectively set a limit of one week on consideration, calling another special meeting to take up her proposal only one week later, on January 17th. Stewart has sought to pressure Democrats to approve her proposal. In a Twitter comment before the January 10th meeting, she said, “Big debt fixing plans on #New Britain city council agenda Wednesday night will newly elected dems save the city? Or will they let us fail.”

Democrats say that the additional refinancing options provided to them in recent days did not address key concerns that they had raised. But when Democrats asked for more time and consideration, Stewart called the January 17th special meeting to order without enough members present to form a quorum to conduct official business. Though the meeting could not officially convene, Stewart allowed Republicans to speak. Fuming at Democrats’ absence, Stewart called it a, “dereliction of your duty.”

But the Council’s President Pro-Tempore, Democratic Ald. Eva Magnuszewski (D-AL) said, “We asked for the meeting to be cancelled. Each of the 5 bonding restructuring plans adds at least $35 million dollars to the $380,134,000 we are being asked to refinance.”

“Is it fair to borrow this much from future generations?”Magnuszewski asked.

Democrats have expressed exasperation with Stewart’s policies of refinancing debt, saying that her past refinancing plans have increased the city’s total debt obligation from $302 million to $380 million. According to Democrats, Stewart’s latest plan would increase taxpayers’ debt obligation to $449 million.

“We made it clear we were not ready and find it disingenuous that the Mayor would try to proceed without us,” said Magnuszewski. “Most importantly, the public did not have an opportunity to weigh in on this.”

Magnuszewski added, “We did not have a consensus after receiving answers to our questions on Tuesday night.”

Under Stewart’s debt plan, city taxpayers would be making smaller payments on existing city debt in the current year and next eight years, with the largest savings being in the three years following the current year. After the year 2026, however, taxpayer payments on existing city debt would increase, becoming dramatically higher over the course of twenty-one years. The plan would add an additional ten years to the taxpayer’s payments on existing city debt.

From the city’s debt underwriter, Mesirow Financial.

Stewart has come under intense criticism for having pushed millions of dollars of debt into the future, to artificially lower costs during her administration, at the expense of higher debt payments for city taxpayers into the future. A graph from the city was obtained showed that this past “debt restructuring,” has resulted in a reduction in short-term debt payments and a spike in taxpayer debt payments in upcoming years.

Graphic shows New Britain’s escalating debt payments from debt restructuring. (Source: Municipal Budget Book)

Stewart’s opponent in the 2017 Mayoral election, Merrill Gay, had highlighted concerns about the effect of Stewart’s refinancing policies on the city’s future.

That appeared to be confirmed by John Healey, Stewart’s former Chief of Staff and a current Managing Director for the city’s debt underwriter, Mesirow Financial. In a presentation before the City Council on December 11, 2017, Healey admitted that, “A lot of what was said over the course of the campaign, as far as, you know, the city’s restructuring and the debt that, the debt spikes that are out there – that was absolutely true.”

Gay commented on Facebook on January 10th that, “For the 3rd time in three years, Mayor Stewart is proposing to refinance the city’s debt. Each time, it has been for one purpose, to get her through the next budget without a tax increase or major cuts.”

“What the mayor has done is the equivalent of paying the MasterCard with the Visa,” Gay commented. “When you can’t pay the debt you owe, the answer is not to borrow more money,” adding that Stewart, “borrows the money from our kids to spend it now.”

Council Approves Scaled-Down Version of Stewart Borrowing Plan

March 29, 2018

The City Council has approved a $99 million, scaled down version of Republican Mayor Erin Stewart’s original plan to borrow $115 million to push city debt into the future.

While tension had risen last week, after reports, called, “misleading,” and, “inaccurate,” that a debt deal had already been concluded, discussions reportedly continued right up to the day of the vote. In the end, in their meeting on March 28, 2018, all fifteen members of the Council voted to approve the scaled-down debt authorization.

“I think, at the end of the day,” Council Majority Leader Carlo Carlozzi, Jr. (D-5) said, “the city is in a much better situation than we would have been initially.”

John Healey, a Managing Director for the city’s debt underwriter, Mesirow Financial, presented two possible plans for borrowing and debt restructuring to the City Council that he said were in response to concerns that had been raised, principally by Council Democrats. Healey said that the decision of the Council on March 28th would be authorizing the borrowing, but not deciding on a specific plan for restructuring.

Under Stewart’s $115 million plan, city taxpayers would be paying current city debt for an additional ten years, to the year 2047. But, the plans considered by the Council decreased that extension, apparently extending the number of years of repayment by two or three years.

In addition to decreasing the borrowing authorization amount from Stewart’s original $115 million to $99 million, Healey said that the currently estimated amount of borrowing to be done by the city would $90 to $92 million, depending on which of the two restructuring plans will be selected.

According to City Council members, Stewart’s original plan would have added over $69 million to city debt service and increased the city’s total debt obligation from $380 million to $449 million.

The two plans considered by the Council would differ in the amount they would add to the total city obligation. One plan would have a period of lesser amounts of repayment than the other plan, but would, according to Healey cost city taxpayers an additional $70 million in indebtedness. The other plan would involve more aggressive repayment, and cost an additional $64 million.

While Stewart’s original $115 million plan would have apparently created a temporary decrease in city debt repayment during the current budget year and the next two budget years, the two plans considered by the Council would appear to keep city debt payments at around the $24 million per year that the city is projected to owe in the current budget year. That $24 million appears to remain stable in the plans the Council considered for the next seven budget years, before gradually decreasing.

Stewart’s original $115 million borrowing plan would have dramatically decreased the amount of debt repayments for both of the next two city budgets that Stewart would be responsible for putting together during her current term of office. The borrowing would have apparently decreased the amount of debt repayment from around $29 million to around $17.5 million in the upcoming 2018-2019 budget year and from around $36 million to around $20 million in the 2019-2020 budget year. For years after that, the payments would go up to about $26 million per year.

When Stewart proposed her original $115 million plan, she had already faced intense criticism for having pushed millions of dollars of debt payments into what are now the upcoming budget years in order to artificially lower costs during the first few years of her administration. Those “restructuring” transactions resulted in higher upcoming debt payments for city taxpayers, such as the projected annual debt service owed by city taxpayers of $36 million in the 2019-2020 budget year and $39 million in the 2020-2021 budget year.

Last year, a graph from the city was obtained that showed that past Stewart “debt restructuring,” has resulted in a reduction in short-term debt payments during earlier years of her administration, while pushing that debt into a spike in taxpayer debt payments hitting the city budget in upcoming years. Stewart’s opponent in the 2017 Mayoral election, Merrill Gay, had highlighted concerns about the effect of Stewart’s refinancing policies on the city’s future.

Graph showing the effects of past city debt restructuring.

That appeared to be confirmed by Healey in a presentation before the City Council on December 11, 2017, in which he admitted that, “A lot of what was said over the course of the campaign, as far as, you know, the city’s restructuring and the debt that, the debt spikes that are out there – that was absolutely true.”

Stewart and other Republicans had criticized Council Democrats’ decisions to delay action on her original $115 million plan in January, saying that the delays would result in higher cost to taxpayers because of changes in interest rates going forward. Democrats defended the delay, saying that the people of the city expected them to take the time to gain more information and consider other options.

As the Council discussion on March 28th on the $99 million debt authorization came to a close, Carlozzi pointedly asked Healey, “If we voted on January, the 10th, originally, and this is a simple yes or no, would we have locked in the interest rate of January the 10th?”

Healey answered, “No.”

Before voting the approve the scaled down restructuring plan, Carlozzi said, of the plan, “I think that, at the end of the day we will be a better community and better off in future administrations because of this.”