Council Update: Public Hearing On Budget To Be Held April 29th

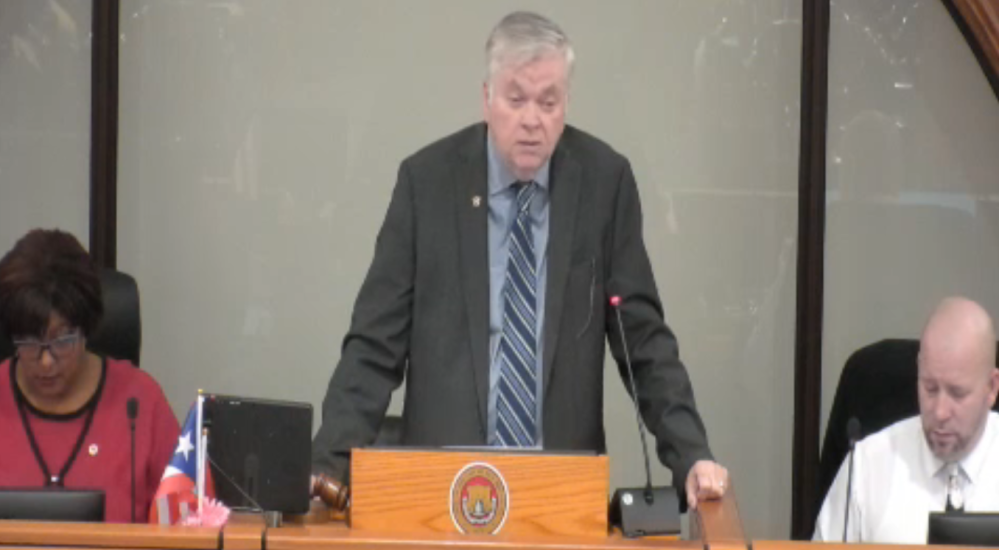

Common Council Begins Review of Mayor’s Proposed Budget for New Fiscal Year

The Common Council will hold a Public Hearing on the Mayor’s proposed Municipal Budget for the next fiscal year on Tuesday, April 29, 2025, at 6 p.m. in Council Chambers, 27 West Main Street.

Individuals seeking to join the public hearing and speak remotely may do so by calling

1 (339) 209-6176. Members of the public not attending in person may view the broadcast via the livestream link: https://www.newbritainct.gov/meetings

“The public hearing is an important part of the process for residents to share their concerns, ideas and priorities about how the city will maintain services within the limits of anticipated revenues for the year that starts on July 1,” said Council President Francisco Santiago (D-5).

“The Democratic caucus seeks to ensure the final budget delivers fair allocations for essential services and education and considers tax relief for seniors and limited income households,” said Alderman John McNamara (D-4), the Council Majority Leader.

“Our goal is a balanced budget that prioritizes essential services and addresses neighborhood needs. Hearing from residents at the public hearing will help us over the next five weeks,” said Assistant Majority Leader Iris Sanchez (D-3). The deadline for the Council to adopt a budget is June 4.

Following the April 29th public hearing the budget will go to Common Council committees where alderpersons will hear presentations and ask questions. On the schedule are the Planning, Zoning & Housing (PZH) Committee,, Tuesday, May 6th; the Administration, Finance, Law & Public Services Committee (AFLPS), Wednesday, May 7th, and a AFLPS special meeting with the Board of Education on Thursday, May 8th. All budget meetings begin at 6 p.m. The Common Council will review the mayor’s fiscal plan and adopt the final capital and operating budgets by June deadline.

Democratic Caucus – New Britain Common Council Update

At an April 9th special meeting the Mayor sent a $273,493,952 proposal to the Council. It represents a $3,961,219 increase in spending over the current fiscal year and sets a 39.18 mill rate on real estate and personal property, a .41 of a mill reduction over the current 39.59 rate. The proposed decrease follows higher tax bills in the two previous years. The 2024 property tax yield jumped $15,835,516 and was 12.58 percent more than 2023 after revaluation sent property assessments soaring. The higher values caused a drop in the mill rate from 49.50 to 38.28 but resulted in the highest tax bills in memory for single and multi family dwellings. Over two years current taxes are up $20,598,252 (16%) after the mill rate increased last year to 39.59. One mill rate now represents $3,425.361.

The Mayor’s budget calls for modest increases to most city departments. It continues to hold the appropriation for the Board of Education to $128 million, the same amount as 2024-2025. An additional $2,646,191 is included in a “non-operating” budget line for education that the BOE must request once the fiscal year begins after July. The Board of Finance and Taxation reduced the BOE’s proposed 11 percent increased budget of $142,612,481 by $12,052,481 and Mayor Stewart cut another $2,560,000 to $128,000,000 in direct appropriations. When non-operating funds are added next year local school aid will total $131,251,665, $1,183,626 more than 2025.

Aside from Board of Education costs, employee benefits ($31,403,152) and payments for the city’s debt ($26,053,783) are the highest estimated expenses.

On the revenue side the Mayor’s budget estimates $145,420,396 will be raised via property taxes, $72,360,710 from state Educational Cost Sharing (ECS) and $24,813,085 in other state grants. The Administration expects $22,749,761 in non-tax revenue, a $5,427,517 increase over the current year. Final amounts for state grants and ECS will be determined by the Governor and State Legislature in the coming weeks and are expected to bring an increase in support from the state for special education and additional funding the city receives as an Alliance District. State and federal aid funds account for well over half of overall spending for schools. New Britain currently ranks 160th out of 165 districts in the amount of local funding for education at $16,814 per pupil. The state’s median is $21,676.

Resolution Increases Tenant Access To Fair Rent Commission

The Common Council amended the city’s Fair Rent Commission procedures at the April 23rd meeting to allow more tenants to file complaints if their rent increases are deemed excessive by the FRC.

In a resolution sponsored by Aldermen Neil Connors (D-4) and Jarrell Hargraves (R-2) and adopted unanimously, the city’s FRC ordinance makes one change for tenants to be able to seek relief. The revision allows tenants who have been served a notice to quit but not a summary eviction by their landlord access to the FRC complaint process.

Under the current ordinance adopted by the city in 2012 the FRC was unable to accept excessive rent complaints if landlords have already “begun the eviction process”, including notices to quit and before a summary process begins. The new language states tenants are ineligible when landlords “have already begun a summary process eviction against a tenant for nonpayment of rent.” The ordinance also prohibits tenants from filing complaints “if they owe back rent” or “have already signed leases agreeing to the requested rent.”

The nine-member FRC consists of three tenants, three landlords and three property owners and has authority to reduce rent increases to ensure that the amounts “are not harsh and unconscionable.” If mediation fails the commission conducts hearings and receives complaints from eligible tenants.

Fair Rent Commission: How To File A Complaint

Contact Jerrell Hargraves, 27 West Main Street 06051

Tel: (860) 826-3410 | Email: jerrell.hargraves@newbritainct.gov

Audit Committee To Review Finances And Audit Proposals

The Audit Subcommittee of the Common Council will discuss the annual audit and state and federal single audit reports for the year ending June 30, 2024 at an April 30th 6 p.m. meeting in Council Chambers at City Hall.

The independent audit was completed on March 31st three months after the December 31, 2024 deadline. Its delivery came sooner than the audits for 2023 and 2022 that were six months or more late. Auditors in prior years cited weaknesses and a noncompliance issue to explain delays. The audit for fiscal year 2024 reports several problems have been addressed and a compliance issue has been resolved. The latest audit cites one deficiency in financial reporting that recommends “the city develop a formal financial close process to ensure each fund’s year-end balances are analyzed timely and corrected appropriately.” The finding stems from “a shortage in staffing within the finance department to review balances.”

Financial highlights from the last fiscal year according to CliftonLarsonAllen (CLA) include:

- the net position of governmental activities increased by $12.1 million,

- In governmental activities , the city had revenues of $462.3 million and expenses of $452.1 million.

- The net position of business-type activities increased $842,000. Revenues were $15.8 million while expenses were $13.1 million.

- The General Fund reported a fund balance of $34.9 million of which $9.9 million was assigned and $25 million unassigned.

- The tax collection rate for the current levy was 96.31%

On May 1 the audit subcommittee will also review proposals for auditing services over the next three years for approval by the Common Council.