Stewart Calls Special Council Meeting to Borrow $115 Million to Push Debt into Future

Republican Mayor Erin Stewart has called a special meeting of the City Council to consider a plan to borrow $115 million to, “Refund Any of the City’s Outstanding General Obligation Bonds.”

Stewart issued her official warrant calling the meeting on January 3, 2018. On the same day, the city’s debt underwriter, Mesirow Financial, issued an Executive Summary of a plan, bearing the city’s seal, for a 2018, “Debt Restructuring.” This document discusses a plan involving borrowing money to lower debt payments in the short term at a cost of rising future taxpayer debt costs.

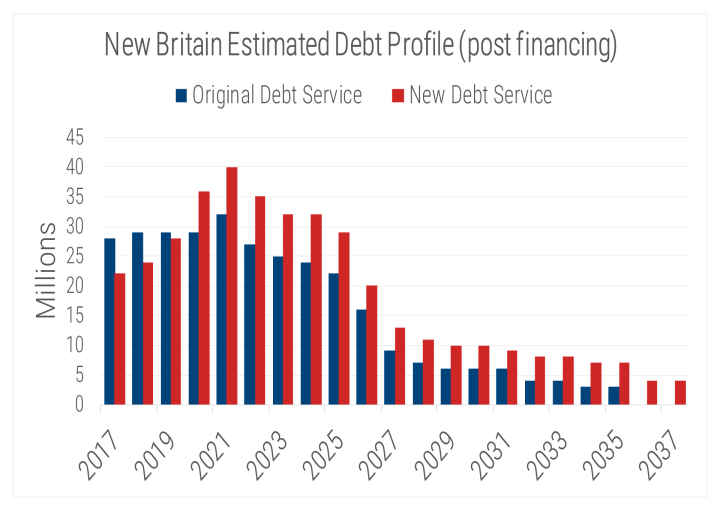

Stewart has come under intense criticism for having already pushed millions of dollars of debt into the future, to artificially lower costs during her administration, at the expense of higher debt payments for city taxpayers into the future. A graph from the city was obtained that showed that this “debt restructuring,” has resulted in a reduction in short-term debt payments and a spike in taxpayer debt payments in upcoming years.

While Stewart has dismissed critiques about city debt under her administration as politics, a major credit rating agency downgraded its assessment of New Britain, citing city debt and spiking debt payments in its analysis.

John Healey, Stewart’s former Chief of Staff and a current Managing Director for Mesirow, in a presentation before the City Council on December 11, 2017, admitted that, “A lot of what was said over the course of the campaign, as far as, you know, the city’s restructuring and the debt that, the debt spikes that are out there – that was absolutely true.”

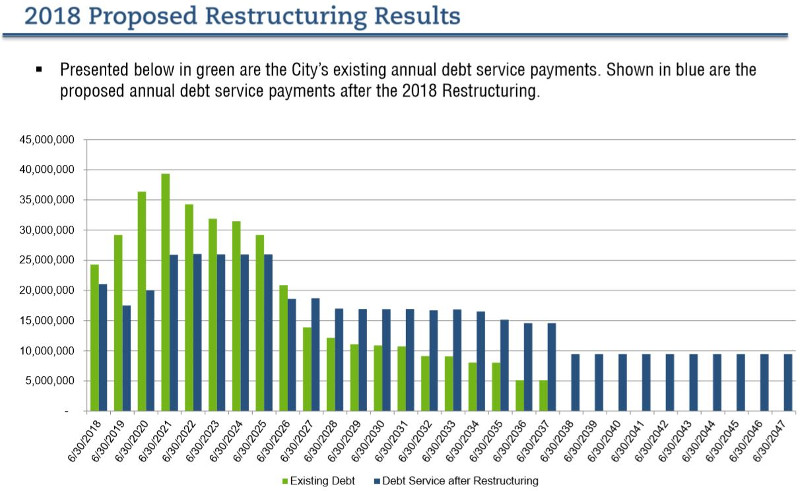

The new 2018 “debt restructuring” plan in the January 3rd Mesirow document would be of a more substantial scope. The plan would use up to $115 million dollars in city borrowing to pay existing city bonds, creating new debt that would push continuing taxpayer debt payments into the future.

City taxpayers would be making smaller payments on existing city debt in the current year and next eight years, with the largest saving being in the three years following the current year.

After the year 2026, however, taxpayer payments on existing city debt would increase, becoming dramatically higher over the course of twenty-one years. The plan would add an additional ten years to the taxpayer’s payments on existing city debt.

As part of the plan, the proposed Council resolution would also authorize Stewart to pay, “applicable redemption premiums.” Redemption premiums would generally refer to additional amounts that the city would have to pay in order to pay the city’s existing debt early.

In addition to refinancing existing bonds, the plan in the Mesirow document would also use new city borrowing to pay, “interest on outstanding bonds through and including March 2020.” The proposed Council resolution would authorize Stewart, “to pay interest costs on such bonds through June 30, 2020.”

The special City Council meeting is to be held on January 10, 2018 at 6:45pm in the Council Chambers on the second floor of City Hall.

Editor’s Note (3/31/2018): The article was corrected to note that Mesirow Financial is the city’s debt underwriter.